What Is Included In A Decedent S Gross Estate . The value of the gross estate of the decedent shall be determined by including to the extent provided for in this. Web the first step in figuring out if your estate will be liable for estate taxes is to determine what is included in your. Web gross estate includes all personal or real, intangible or intangible, property you own. 2036 (a) requires that a decedent’s gross estate must include the value of property transferred by trust, or otherwise, in which the decedent retains the right. You can evaluate the value of this total amount in one of two. All assets in which the decedent had an. Web this information is needed for several reasons, most notably probate and estate tax purposes.

from www.studocu.com

2036 (a) requires that a decedent’s gross estate must include the value of property transferred by trust, or otherwise, in which the decedent retains the right. Web gross estate includes all personal or real, intangible or intangible, property you own. The value of the gross estate of the decedent shall be determined by including to the extent provided for in this. Web this information is needed for several reasons, most notably probate and estate tax purposes. You can evaluate the value of this total amount in one of two. Web the first step in figuring out if your estate will be liable for estate taxes is to determine what is included in your. All assets in which the decedent had an.

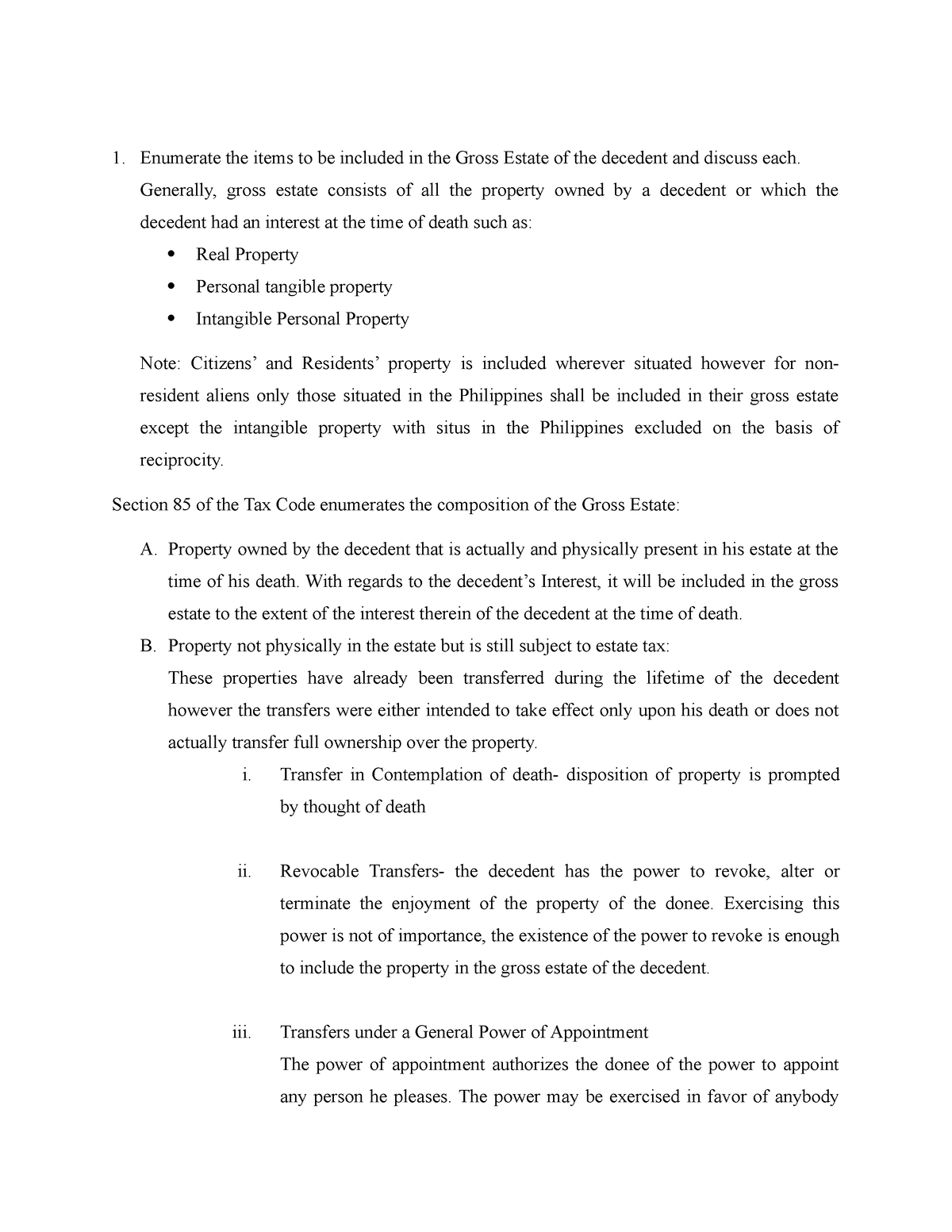

Estate Tax Summary Notes Enumerate the items to be included in the

What Is Included In A Decedent S Gross Estate You can evaluate the value of this total amount in one of two. All assets in which the decedent had an. The value of the gross estate of the decedent shall be determined by including to the extent provided for in this. Web this information is needed for several reasons, most notably probate and estate tax purposes. Web gross estate includes all personal or real, intangible or intangible, property you own. 2036 (a) requires that a decedent’s gross estate must include the value of property transferred by trust, or otherwise, in which the decedent retains the right. You can evaluate the value of this total amount in one of two. Web the first step in figuring out if your estate will be liable for estate taxes is to determine what is included in your.

From slideplayer.com

Estates and Trusts Their Nature and the Accountant’s Role ppt download What Is Included In A Decedent S Gross Estate You can evaluate the value of this total amount in one of two. Web this information is needed for several reasons, most notably probate and estate tax purposes. Web gross estate includes all personal or real, intangible or intangible, property you own. All assets in which the decedent had an. 2036 (a) requires that a decedent’s gross estate must include. What Is Included In A Decedent S Gross Estate.

From www.scribd.com

An InDepth Analysis of the Properties to be Included in a Decedent's What Is Included In A Decedent S Gross Estate Web this information is needed for several reasons, most notably probate and estate tax purposes. The value of the gross estate of the decedent shall be determined by including to the extent provided for in this. 2036 (a) requires that a decedent’s gross estate must include the value of property transferred by trust, or otherwise, in which the decedent retains. What Is Included In A Decedent S Gross Estate.

From www.uslegalforms.com

Maryland Claim Against Decedent's Estate US Legal Forms What Is Included In A Decedent S Gross Estate All assets in which the decedent had an. Web this information is needed for several reasons, most notably probate and estate tax purposes. You can evaluate the value of this total amount in one of two. Web the first step in figuring out if your estate will be liable for estate taxes is to determine what is included in your.. What Is Included In A Decedent S Gross Estate.

From www.studocu.com

Exercises Property Regime GROSS ESTATE OF MARRIED DECEDENT MARRIAGE What Is Included In A Decedent S Gross Estate Web this information is needed for several reasons, most notably probate and estate tax purposes. The value of the gross estate of the decedent shall be determined by including to the extent provided for in this. Web gross estate includes all personal or real, intangible or intangible, property you own. Web the first step in figuring out if your estate. What Is Included In A Decedent S Gross Estate.

From slideplayer.com

Corporate Tax Copyright ppt download What Is Included In A Decedent S Gross Estate You can evaluate the value of this total amount in one of two. Web this information is needed for several reasons, most notably probate and estate tax purposes. Web gross estate includes all personal or real, intangible or intangible, property you own. The value of the gross estate of the decedent shall be determined by including to the extent provided. What Is Included In A Decedent S Gross Estate.

From slideplayer.com

Taxation of Individuals and Business Entities ppt download What Is Included In A Decedent S Gross Estate Web the first step in figuring out if your estate will be liable for estate taxes is to determine what is included in your. The value of the gross estate of the decedent shall be determined by including to the extent provided for in this. Web gross estate includes all personal or real, intangible or intangible, property you own. You. What Is Included In A Decedent S Gross Estate.

From www.studocu.com

Gross estate Lecture notes 1 GROSS ESTATE Succession is a mode of What Is Included In A Decedent S Gross Estate Web the first step in figuring out if your estate will be liable for estate taxes is to determine what is included in your. Web gross estate includes all personal or real, intangible or intangible, property you own. 2036 (a) requires that a decedent’s gross estate must include the value of property transferred by trust, or otherwise, in which the. What Is Included In A Decedent S Gross Estate.

From www.youtube.com

Gross Estate of Married Decedents Part 5 Absolute Community of What Is Included In A Decedent S Gross Estate The value of the gross estate of the decedent shall be determined by including to the extent provided for in this. You can evaluate the value of this total amount in one of two. Web the first step in figuring out if your estate will be liable for estate taxes is to determine what is included in your. Web this. What Is Included In A Decedent S Gross Estate.

From www.scribd.com

Tax 42 Chapter 3 An InDepth Examination of Transfers Included in a What Is Included In A Decedent S Gross Estate Web gross estate includes all personal or real, intangible or intangible, property you own. 2036 (a) requires that a decedent’s gross estate must include the value of property transferred by trust, or otherwise, in which the decedent retains the right. Web the first step in figuring out if your estate will be liable for estate taxes is to determine what. What Is Included In A Decedent S Gross Estate.

From www.studocu.com

Gross Estate For Married Decedents What is a separate or common What Is Included In A Decedent S Gross Estate 2036 (a) requires that a decedent’s gross estate must include the value of property transferred by trust, or otherwise, in which the decedent retains the right. Web the first step in figuring out if your estate will be liable for estate taxes is to determine what is included in your. All assets in which the decedent had an. Web gross. What Is Included In A Decedent S Gross Estate.

From www.studocu.com

Estate Tax Summary Notes Enumerate the items to be included in the What Is Included In A Decedent S Gross Estate Web this information is needed for several reasons, most notably probate and estate tax purposes. All assets in which the decedent had an. 2036 (a) requires that a decedent’s gross estate must include the value of property transferred by trust, or otherwise, in which the decedent retains the right. The value of the gross estate of the decedent shall be. What Is Included In A Decedent S Gross Estate.

From www.studocu.com

Deduction FROM THE Gross Estate DEDUCTION FROM THE GROSS ESTATE What Is Included In A Decedent S Gross Estate 2036 (a) requires that a decedent’s gross estate must include the value of property transferred by trust, or otherwise, in which the decedent retains the right. You can evaluate the value of this total amount in one of two. Web this information is needed for several reasons, most notably probate and estate tax purposes. The value of the gross estate. What Is Included In A Decedent S Gross Estate.

From slideplayer.com

Corporate Tax Copyright ppt download What Is Included In A Decedent S Gross Estate Web this information is needed for several reasons, most notably probate and estate tax purposes. 2036 (a) requires that a decedent’s gross estate must include the value of property transferred by trust, or otherwise, in which the decedent retains the right. Web gross estate includes all personal or real, intangible or intangible, property you own. All assets in which the. What Is Included In A Decedent S Gross Estate.

From www.scribd.com

Activity Gross Estate of A Single Decedent PDF What Is Included In A Decedent S Gross Estate The value of the gross estate of the decedent shall be determined by including to the extent provided for in this. Web the first step in figuring out if your estate will be liable for estate taxes is to determine what is included in your. All assets in which the decedent had an. You can evaluate the value of this. What Is Included In A Decedent S Gross Estate.

From www.chegg.com

Solved Betty's adjusted gross estate is 18 million. The What Is Included In A Decedent S Gross Estate All assets in which the decedent had an. You can evaluate the value of this total amount in one of two. Web this information is needed for several reasons, most notably probate and estate tax purposes. The value of the gross estate of the decedent shall be determined by including to the extent provided for in this. Web gross estate. What Is Included In A Decedent S Gross Estate.

From www.teachmepersonalfinance.com

IRS Form 4422 Discharging Property Subject to an Estate Tax Lien What Is Included In A Decedent S Gross Estate The value of the gross estate of the decedent shall be determined by including to the extent provided for in this. You can evaluate the value of this total amount in one of two. Web gross estate includes all personal or real, intangible or intangible, property you own. Web this information is needed for several reasons, most notably probate and. What Is Included In A Decedent S Gross Estate.

From www.scribd.com

Gross Estate of Married Decedent Marriage Settlement PDF Property What Is Included In A Decedent S Gross Estate Web this information is needed for several reasons, most notably probate and estate tax purposes. Web the first step in figuring out if your estate will be liable for estate taxes is to determine what is included in your. All assets in which the decedent had an. Web gross estate includes all personal or real, intangible or intangible, property you. What Is Included In A Decedent S Gross Estate.

From www.chegg.com

Solved Problem Gross Estate For each type of decedent, What Is Included In A Decedent S Gross Estate Web gross estate includes all personal or real, intangible or intangible, property you own. Web the first step in figuring out if your estate will be liable for estate taxes is to determine what is included in your. All assets in which the decedent had an. 2036 (a) requires that a decedent’s gross estate must include the value of property. What Is Included In A Decedent S Gross Estate.